Hot Templates

houseofcardssmooth slow motion onlineviral slowmo dumpproduct photography near mecreate slow motion videobest family photographers near mefunnyvideoavid slow motioncagraduation photo studiochair3Hug Boyfriend AIbest app for video slow motionflow velocityKpop Demon Hunter aikings beachhome photo studiogirllikemejjkenyalwaiting chair 3 seater

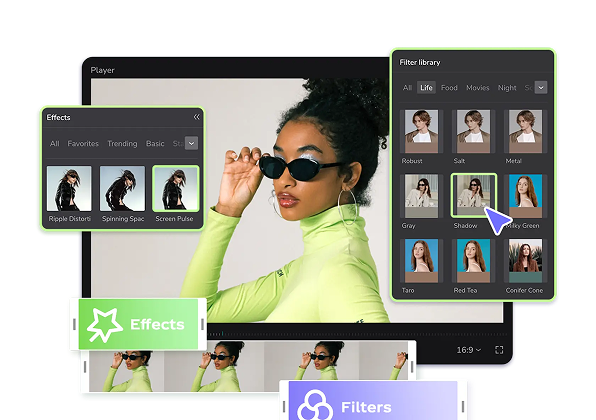

Free cash flow kpis Templates by CapCut

Add new video

00:06

1.7k

Cracka Flow Lyrics

00:16

4.1k

I’m about

00:12

12.2k

Try new template

00:14

253.4k

F*ck em’

00:06

1.1k

Flawless victory

houseofcards

smooth slow motion online

viral slowmo dump

product photography near me

00:13

6.3k

I DON'T LOSE

00:12

6.3k

I love pills & perc

00:12

57.9k

Kay flock™️💯🔥

00:08

5.6k

Should Of Saw It 🩸

00:13

39.9k

Olaf text

00:12

25.7k

Switches n Dracs 🔫

00:11

2.5m

NEW TRENDING EDIT

00:16

9.0k

SCREWLY G 🔥🧨🔥

00:14

638

2055 - Sleepy Hollow

00:10

23.7k

Nle Choppa 💯

00:22

1.4k

Big Stepper Tenplate

00:12

15.5k

W collab with ant!🔥

00:18

179.6k

Hey Siri Whats Aura?